National Restaurant Association

National Restaurant Association

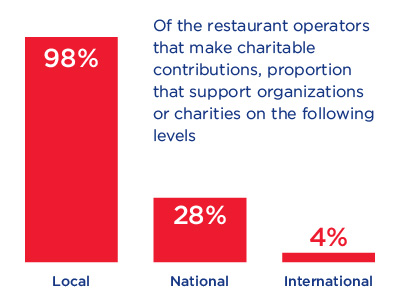

Giving selflessly to charity has long been considered the hallmark of a beneficent character. And many restaurateurs, quite admirably, do it because it is the right thing to do without being aware of the associated financial rewards. The tax code provides restaurateurs some degree of tax relief that is available to businesses in general that give back to their communities, but few of them are aware of the most recent legislation that aims specifically at rewarding restaurateur for their charitable giving, a fact that has not gone unnoticed by restaurant CPAs, the contemporary restaurant consultant, and other restaurant advisors.

Last summer, in what was considered a rare bipartisan effort, the U.S. Congress passed H.R. bill 4719, titled America Gives More Act of 2014, which essentially augments the traditional tax benefits afforded to businesses by enhancing these deductions for contributions to food charities. The deduction effectively lowers the tax bill of restaurant services, but what is even more significant is the fact that their food donations act as a vital implement in the never-ending battle against hunger by reducing the overall cost of the charitable organizations that act as the intermediaries between the needy and the charitable donors. The bill marks a watershed event because for nearly thirty years tax deductions related to food donations was limited to C-corps in a restaurant industry where the majority of restaurants are organized as either sole proprietorships or partnerships. And now by permitting the non-C-corps the tax advantage of the deduction, the National Restaurant Association reports that food donations increased by an astounding 127% since the passage of the bill!

Here are some things to consider if you want to give back to your community while taking advantage of these remarkable financial rewards:

According to a prominent restaurant consulting firm, the first step is to choose an organization to which you want to donate regularly. There are many organizations out there worthy of consideration for this effort, but your selection should be based on your personal values not only as a person but as a restaurant business owner:

• Start by looking into existing community events that align with your personal values.

• Ask customers to suggest ideas.

• Work with local school districts.

• Act as a host to holiday celebrations.

• Designate certain days during which you will allocate a certain percentage of sales towards donations.

• Contribute part of the restaurant proceeds to hunger-relief programs.

• Donate to emergency relief workers after a major disaster. Aside from the tax benefit, your restaurant will get free publicity, an invaluable commodity.

• Donate inventory surplus to a food bank (National Restaurant Association).

Regardless of which resource you use, do keep in mind the most important aspect of this law, namely that this new benefit now helps restaurant management recapture, in part, many of the costs related to the preparation of food held in reserve for charity, and this helps reduce food waste while helping to nourish those in need instead, eliminating the need to send edible food to a landfill, a benefit that should be a working part of every comprehensive restaurant design.